How To Calculate Fixed Manufacturing Overhead . For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. calculate manufacturing overhead costs by summing up your facility’s indirect expenses. manufacturing overhead costs are divided into three broad categories: a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. For example, if you’re using units produced, you would need to first determine your total cost for each unit. to calculate manufacturing overhead for wip, you’ll need to determine your base. Divide this by the total number of units for a per unit cost. to calculate manufacturing overhead, combine all manufacturing overhead costs.

from cekplmqt.blob.core.windows.net

For example, if you’re using units produced, you would need to first determine your total cost for each unit. manufacturing overhead costs are divided into three broad categories: to calculate manufacturing overhead, combine all manufacturing overhead costs. Divide this by the total number of units for a per unit cost. calculate manufacturing overhead costs by summing up your facility’s indirect expenses. to calculate manufacturing overhead for wip, you’ll need to determine your base. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed.

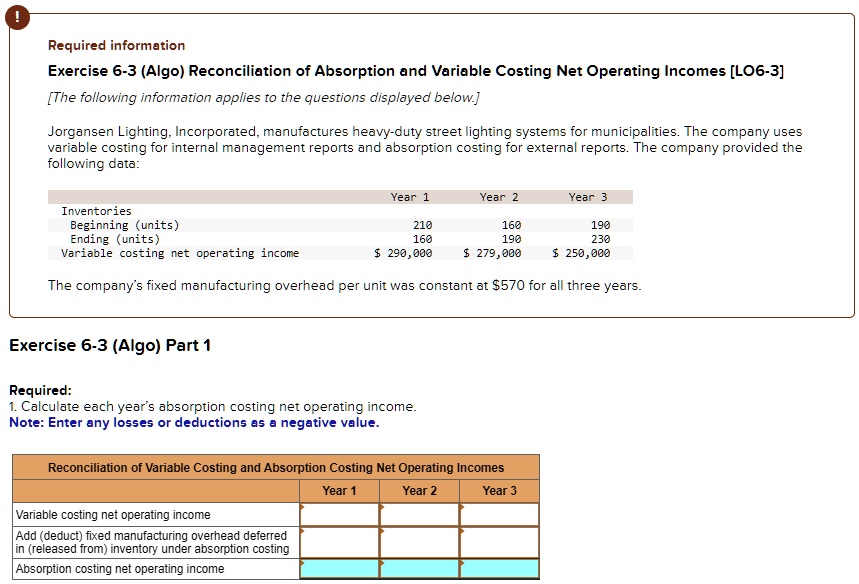

How To Calculate Fixed Manufacturing Overhead Cost Deferred In

How To Calculate Fixed Manufacturing Overhead a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. to calculate manufacturing overhead for wip, you’ll need to determine your base. Divide this by the total number of units for a per unit cost. manufacturing overhead costs are divided into three broad categories: For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. For example, if you’re using units produced, you would need to first determine your total cost for each unit. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. calculate manufacturing overhead costs by summing up your facility’s indirect expenses. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. to calculate manufacturing overhead, combine all manufacturing overhead costs.

From www.chegg.com

Solved E911 (Algo) Calculating Fixed Manufacturing Overhead How To Calculate Fixed Manufacturing Overhead calculate manufacturing overhead costs by summing up your facility’s indirect expenses. to calculate manufacturing overhead, combine all manufacturing overhead costs. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. to. How To Calculate Fixed Manufacturing Overhead.

From keplarllp.com

👍 How to calculate manufacturing overhead allocated. Allocating How To Calculate Fixed Manufacturing Overhead Divide this by the total number of units for a per unit cost. For example, if you’re using units produced, you would need to first determine your total cost for each unit. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. to calculate manufacturing overhead, combine all manufacturing overhead costs. . How To Calculate Fixed Manufacturing Overhead.

From www.educba.com

Manufacturing Overhead Formula Calculator & Excel Examples How To Calculate Fixed Manufacturing Overhead manufacturing overhead costs are divided into three broad categories: a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. to calculate manufacturing overhead, combine all manufacturing overhead costs. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for. How To Calculate Fixed Manufacturing Overhead.

From cekplmqt.blob.core.windows.net

How To Calculate Fixed Manufacturing Overhead Cost Deferred In How To Calculate Fixed Manufacturing Overhead Divide this by the total number of units for a per unit cost. manufacturing overhead costs are divided into three broad categories: the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. calculate manufacturing overhead costs by summing up your facility’s indirect expenses. For example, if you’re using units produced, you. How To Calculate Fixed Manufacturing Overhead.

From shiftednews.com

How to Calculate Manufacturing Overhead Shifted News How To Calculate Fixed Manufacturing Overhead a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. to calculate manufacturing overhead for wip, you’ll need to determine your base. Divide this by the total number of units for a per unit cost. manufacturing overhead costs are divided into three broad categories: the straightforward software can. How To Calculate Fixed Manufacturing Overhead.

From www.luyemedical.com

How to Calculate Manufacturing Overhead Costs Luye Medical How To Calculate Fixed Manufacturing Overhead calculate manufacturing overhead costs by summing up your facility’s indirect expenses. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. to calculate manufacturing overhead for wip, you’ll need to determine your base. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22. How To Calculate Fixed Manufacturing Overhead.

From planergy.com

Manufacturing Overhead Formula What Is It And How To Calculate It How To Calculate Fixed Manufacturing Overhead manufacturing overhead costs are divided into three broad categories: a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. Divide this by the total number of units for a per unit cost. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22. How To Calculate Fixed Manufacturing Overhead.

From cekplmqt.blob.core.windows.net

How To Calculate Fixed Manufacturing Overhead Cost Deferred In How To Calculate Fixed Manufacturing Overhead a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. to calculate manufacturing overhead for wip, you’ll need to determine your base. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. the straightforward. How To Calculate Fixed Manufacturing Overhead.

From www.akounto.com

Manufacturing Overhead Definition & Examples Akounto How To Calculate Fixed Manufacturing Overhead to calculate manufacturing overhead for wip, you’ll need to determine your base. For example, if you’re using units produced, you would need to first determine your total cost for each unit. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. the straightforward. How To Calculate Fixed Manufacturing Overhead.

From ceokzrxa.blob.core.windows.net

How To Calculate Fixed Overhead Budget Variance at June Abbott blog How To Calculate Fixed Manufacturing Overhead calculate manufacturing overhead costs by summing up your facility’s indirect expenses. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. Divide this by the. How To Calculate Fixed Manufacturing Overhead.

From accountingqa.blogspot.com

Accounting Q and A EX 2315 flexible overhead budget How To Calculate Fixed Manufacturing Overhead the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. to calculate manufacturing overhead, combine all manufacturing overhead costs. manufacturing overhead costs are divided into three broad categories: to calculate manufacturing overhead for wip, you’ll need to determine your base. calculate manufacturing overhead costs by summing up your facility’s. How To Calculate Fixed Manufacturing Overhead.

From www.finance-review.com

You should probably read this Predetermined Overhead Rate Calculator How To Calculate Fixed Manufacturing Overhead the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. Divide this by the total number of units for a per unit cost. calculate manufacturing overhead costs by summing up your facility’s indirect. How To Calculate Fixed Manufacturing Overhead.

From 2012books.lardbucket.org

Fixed Manufacturing Overhead Variance Analysis How To Calculate Fixed Manufacturing Overhead For example, if you’re using units produced, you would need to first determine your total cost for each unit. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. manufacturing overhead costs are divided into three broad categories: calculate manufacturing overhead costs by summing up your facility’s indirect expenses. Divide this. How To Calculate Fixed Manufacturing Overhead.

From www.chegg.com

Solved E914 (Algo) Calculating Fixed Manufacturing Overhead How To Calculate Fixed Manufacturing Overhead the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for. How To Calculate Fixed Manufacturing Overhead.

From www.akounto.com

Overhead Cost Definition, Formula & Examples Akounto How To Calculate Fixed Manufacturing Overhead manufacturing overhead costs are divided into three broad categories: to calculate manufacturing overhead, combine all manufacturing overhead costs. For example, if you’re using units produced, you would need to first determine your total cost for each unit. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. calculate manufacturing overhead. How To Calculate Fixed Manufacturing Overhead.

From circuitlistarblasts123.z22.web.core.windows.net

How To Determine Overhead How To Calculate Fixed Manufacturing Overhead Divide this by the total number of units for a per unit cost. For example, if you’re using units produced, you would need to first determine your total cost for each unit. a common way to calculate fixed manufacturing overhead is by adding the direct labor, direct materials and fixed. to calculate manufacturing overhead for wip, you’ll need. How To Calculate Fixed Manufacturing Overhead.

From haipernews.com

How To Calculate Fixed Manufacturing Overhead Cost Deferred In How To Calculate Fixed Manufacturing Overhead to calculate manufacturing overhead, combine all manufacturing overhead costs. For this example, we’ll say that each manufacturing unit cost $87.78 in direct labor and materials, with $22.22 added on for overhead costs, for a. Divide this by the total number of units for a per unit cost. to calculate manufacturing overhead for wip, you’ll need to determine your. How To Calculate Fixed Manufacturing Overhead.

From slidesharenow.blogspot.com

How Do You Calculate Manufacturing Overhead slideshare How To Calculate Fixed Manufacturing Overhead Divide this by the total number of units for a per unit cost. manufacturing overhead costs are divided into three broad categories: to calculate manufacturing overhead, combine all manufacturing overhead costs. the straightforward software can help business owners accurately calculate manufacturing costs and apply them to production. a common way to calculate fixed manufacturing overhead is. How To Calculate Fixed Manufacturing Overhead.